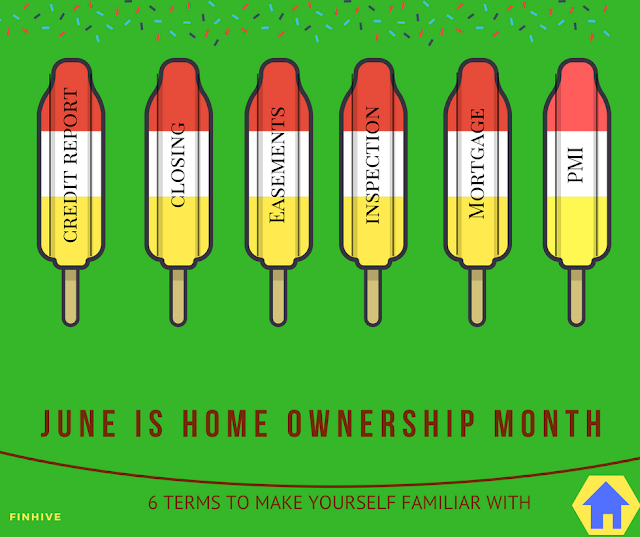

June is Home Ownership Month.

It used to be all about location, location, location. It still is but it's also about credit history, mortgage and affordability. Whether you are first time home buyer, buying a vacation home or just thinking of buying, always do your research first.

Here are some terms and their meanings (from Investopedia) to make yourself familiar with:

Credit Report: A credit report is a detailed report of an individual's credit history. If your report has mistakes, it can impact your ability to get a mortgage.

Closing: The closing process consists of reviewing and signing your loan documents (if you’re taking out a mortgage) and signing the contract for the purchase of your home.

Easements: An easement in real estate is the right of one party to use the property of another party by paying a fee to the property owner.

Inspection: An examination of a real estate property's condition, usually performed in connection with the property's sale.

Mortgage: A mortgage is a debt instrument that the borrower is obliged to pay back with a predetermined set of payments.

PMI: Private Mortgage Insurance or PMI is a type of mortgage insurance that buyers are typically required to pay for a conventional loan when they make a down payment that is less than 20 percent of the home’s purchase price.

Thanks for sharing this informative post.

ReplyDeleteGet Insurance